26+ tax deduction on mortgage

Ad Easy Software To Help You Find All the Tax Deductions You Deserve. Ad Taxes Can Be Complex.

Mortgage Interest Deduction Save When Filing Your Taxes

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

. You can deduct mortgage insurance premiums mortgage interest and real estate taxes that you pay during the year for your. Web Generally with a loan limit of 750K average loan balance of 850K yields a percentage of approximately 88 of interest that would be deductible. For example if you.

Web Mortgage interest. Ad Need Help Filing Your Tax Return. But now the limit is 750000 and.

Web The deduction for mortgage relief was introduced under the Tax Relief and Health Care Act in 2006. Web For 2021 tax returns the government has raised the standard deduction to. At HR Block You Can Get Help Online or In-Office.

Taxes with an extension must be completed no later than. Web Mortgage interest is tax deductible. Congress has voted a few times since then about deductions.

Web A 1000 tax credit would reduce their total tax bill to 9000. Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

You can file for an extension by April 18 2023. For married taxpayers filing separate returns the cap. Web Homeowners filing taxes jointly can deduct all payments for mortgage interest on loans up to 1 million or loans up to 750000 if made after Dec.

Web Allowable deductions for mortgage debt. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. Lets say you paid 10000 in mortgage interest and are.

Web These costs are usually deductible in the year that you purchase the home. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. But for loans taken out from.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web Here are 8 tax deductions and tax credits that may help you save money on taxes including mortgage interest and property tax. For example Lenas first-year interest expense totals 14857.

Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. A 1000 tax deduction would lower their taxable income from 67000 to 66000 -- at the expected. As well including 10 credits for energy.

Web If you meet these conditions then you can deduct all of the payments you actually made during the year to your mortgage servicer the State HFA or HUD on the home mortgage. Single or married filing separately 12550 Married filing jointly or qualifying widow er. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. But if not you can deduct them pro rata over the repayment period. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly.

You can file between January 23 and April 18 2023. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Get Your Max Refund Guaranteed.

At a personal tax rate of 24 this implies tax savings of 3566. Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. Dont Leave Money On The Table with HR Block.

We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Until recently interest paid on a mortgage loan of up to 1 million was deductible.

Free 11 Sample Employee Declaration Forms In Pdf Excel Word

Mortgage Interest Deduction How It Calculate Tax Savings

Is Mortgage Interest Still Deductible After Tax Reform

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Covid 19 Relief Tracker Small Business And Nonprofits Ry Cpas Ry Cpas

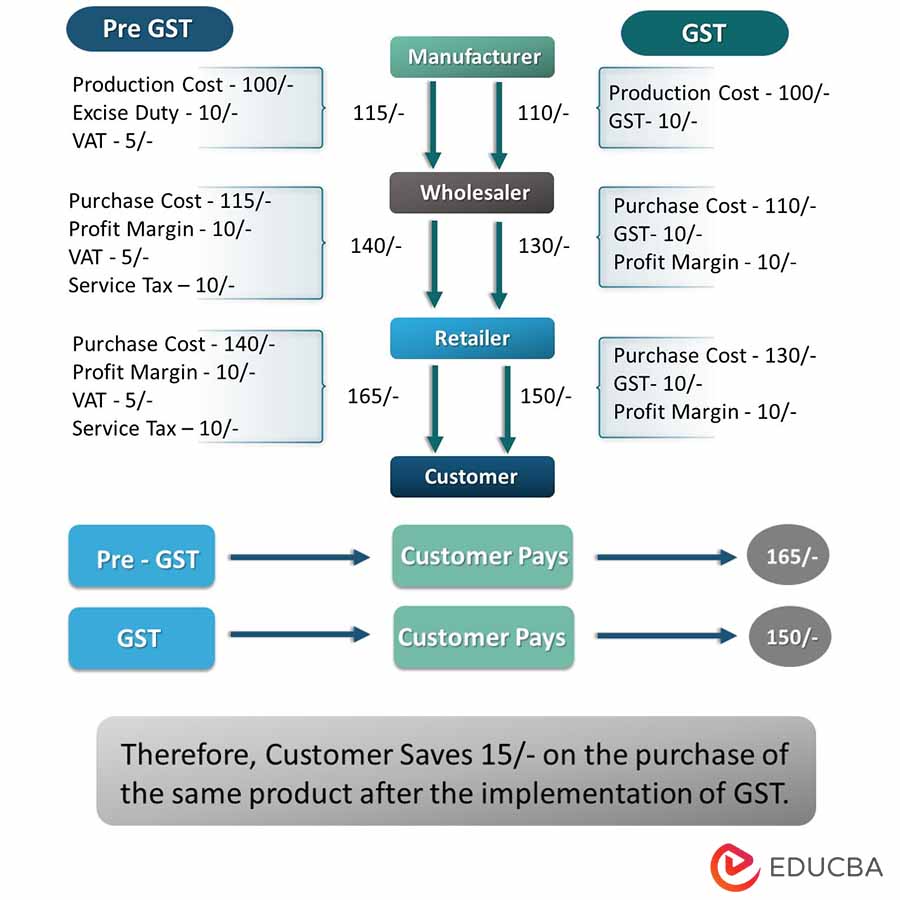

What Is Gst Types Rates Calculation Registration Examples

Open Esds

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Free 8 Sample Employee Tax Forms In Pdf Ms Word

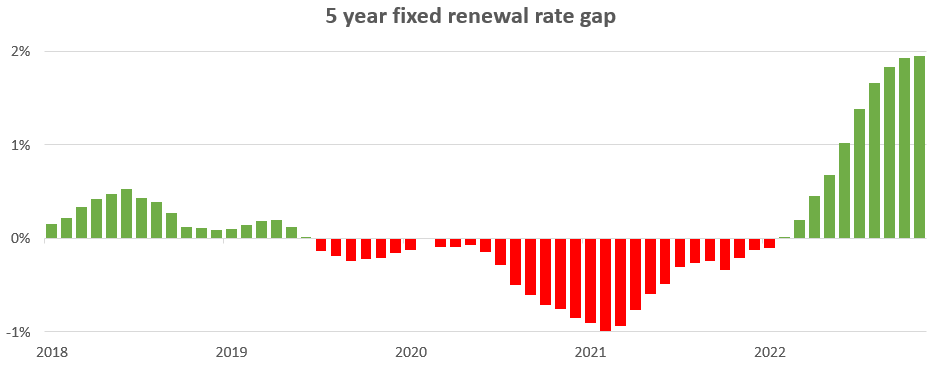

Changing Rates And The Market House Hunt Victoria

Business Succession Planning And Exit Strategies For The Closely Held

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

About Tax Deductions For A Mortgage Turbotax Tax Tips Videos

Mortgage Interest Deduction Bankrate

How Much Of The Mortgage Interest Is Tax Deductible Home Loans